President Donald Trump on Thursday filed a $5 billion lawsuit against JPMorgan Chase and its CEO Jamie Dimon, claiming that the bank improperly closed his accounts for political reasons.

‘While we regret President Trump has sued us, we believe the suit has no merit,’ a JPMorgan Chase spokesperson said. ‘We respect the President’s right to sue us and our right to defend ourselves – that’s what courts are for.’

The suit accuses the bank of libel and breach of implied covenant of good faith and fair dealing. It also says the bank and its chief executive violated Florida trade practices laws.

The suit says Trump held ‘several’ accounts at the firm which were closed.

On Feb. 19, 2021, shortly after the Jan. 6 Capitol Hill riot, the bank notified Trump that the accounts would be closed within two months, the suit also says.

The lawsuit adds to a still-growing list of legal efforts from Trump directed at a wide variety of institutions — from media outlets to tech platforms — many of which have resulted in multimillion-dollar settlements. The president’s company, the Trump Organization, sued Capital One Bank last year over allegations of improper account closures. Capital One said at the time that the allegations have no merit.

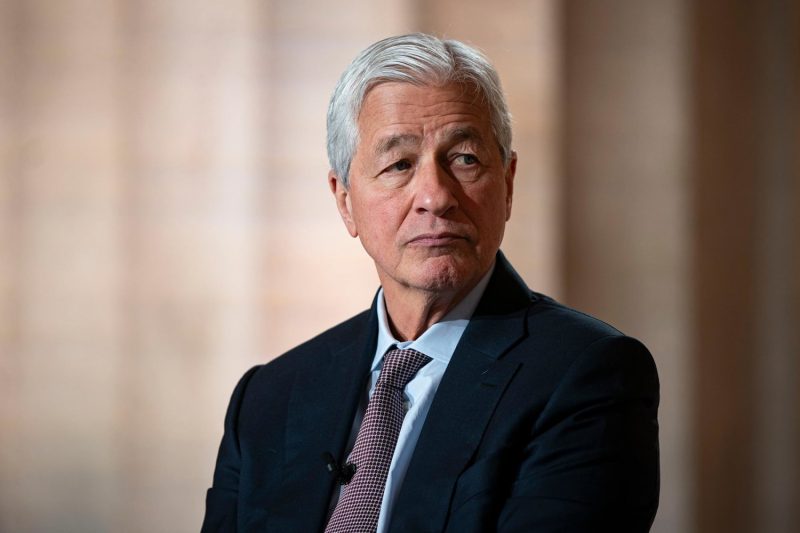

Dimon, as head of JPMorgan Chase, the nation’s largest bank, is among the most influential people in the business world and someone who has been courted for years by Republicans and Democrats. In the run-up to the 2024 election, Trump falsely claimed that Dimon had endorsed him.

Dimon has at times been critical of some Trump policies — most notably inflation — while supportive of others, including efforts to streamline the U.S. government.

On Wednesday, Dimon criticized the Trump administration over its immigration policies.

‘I don’t like what I’m seeing,’ Dimon told attendees at the World Economic Forum in Davos, Switzerland. Dimon also said that while he doesn’t agree with everything the administration does, he does agree with some of its economic policies.

On Saturday, Trump threatened the lawsuit in a Truth Social post. Over the weekend, JPMorgan Chase said it appreciated ‘that this administration has moved to address political debanking and we support those efforts.’

Almost exactly one year ago, Trump used an address at the World Economic Forum to take a shot at JPMorgan and its competitor, Bank of America.

‘I hope you start opening your bank to conservatives because many conservatives complain that the banks are not allowing them to do business,’ Trump said.

“You and Jamie and everybody, I hope you’re going to open your banks to conservatives because what you’re doing is wrong,” Trump said.

Bank of America said that it serves over 70 million consumers and does not close accounts for political reasons. JPMorgan says that it also serves tens of millions of accounts and likewise does not close accounts on political grounds.

In an expletive-laden interview with CNBC last year, Trump vented his frustrations at big banks that close accounts for legal and regulatory reasons.

‘I had JPMorgan Chase — I had hundreds of millions of dollars in cash,’ Trump told the cable network on Aug. 5. ‘I was loaded up with cash, and they told me, ‘I’m sorry, sir, we can’t have you.”

Trump says he was informed he had 20 days to move his assets out of the bank. ‘I said, ‘You got to be kidding. I’ve been with you for 35, 40 years,” the president recounted.

Trump said, ‘then what happens is I call a Bank of America.’

‘And they have zero interest,’ he said. CEO Brian Moynihan ‘was kissing my a– when I was president, and when I called him after I was president to deposit a billion dollars plus and a lot of other things … and he said, ‘we can’t do it.”

The JPMorgan Chase spokesperson said Thursday that the bank ‘does not not close accounts for political or religious reasons. We do close accounts because they create legal or regulatory risk for the company.’

Trump was indicted multiple times after his first term in office. In 2024, he was indicted on charges that he conspired to defraud the United States, conspiracy to to obstruct an official proceeding, obstruction of and attempt to obstruct an official proceeding and conspiracy against rights.

In recent years, banks have faced intense pressure from conservatives leveling ‘debanking’ claims against them. However, banks and their lobbying groups have long maintained that they do not close accounts for political or religious reasons, but they close accounts based primarily on legal or regulatory grounds.

Trump’s administration has sought to ease those regulations in order to make it harder for a bank to close a customer’s account. In August, Trump signed an executive order which sought to end ‘politicized or unlawful debanking activities.’

In September, the Office of the Comptroller of the Currency, one of the top banking regulators, began a review of banking rules to ‘depoliticize the banking system.’