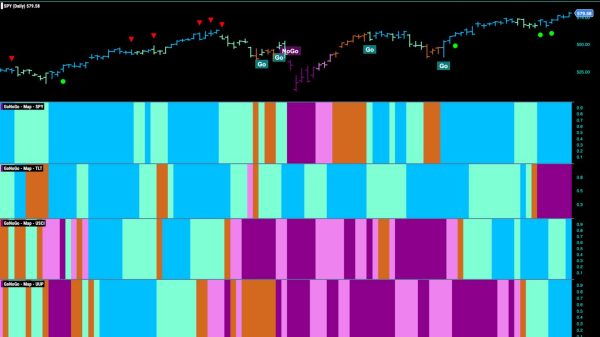

In this video from StockCharts TV, Julius takes a look at rotations in an asset allocation RRG. He compares fixed-income-related asset classes, commodities, the US dollar, Bitcoin and stocks to a balanced portfolio of 60% stocks/40% bonds. The long-lasting outperformance of stocks seems to be coming to an end.

In this video from StockCharts TV, Julius takes a look at rotations in an asset allocation RRG. He compares fixed-income-related asset classes, commodities, the US dollar, Bitcoin and stocks to a balanced portfolio of 60% stocks/40% bonds. The long-lasting outperformance of stocks seems to be coming to an end.

This assessment of asset allocation is then followed by a look at S&P 500 sector rotation using Relative Rotation Graphs broken down into three groups — offensive, defensive, and (economically) sensitive. The current rotation in the defensive group is really standing out.

This video was originally published on September 10, 2024. Click anywhere on the icon above to view on our dedicated page for Julius.

Past episodes of Julius’ shows can be found here.

#StayAlert, -Julius